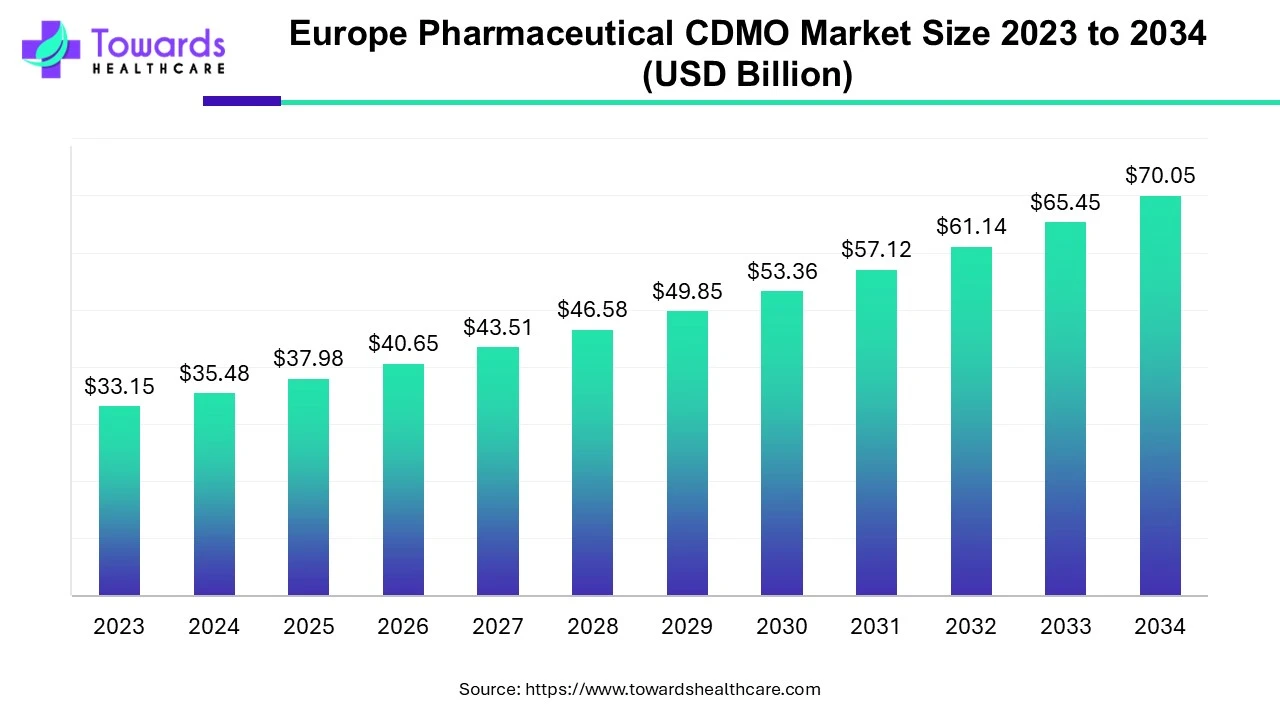

Europe Pharmaceutical CDMO Market Size Expected to Reach USD 70.05 Billion by 2034

The Europe pharmaceutical CDMO market size is calculated at USD 37.98 billion in 2025 and is expected to reach around USD 70.05 billion by 2034, growing at a CAGR of 7.04% for the forecasted period.

Ottawa, Oct. 01, 2025 (GLOBE NEWSWIRE) -- The Europe pharmaceutical CDMO market size was valued at USD 35.48 billion in 2024 and is predicted to hit around USD 70.05 billion by 2034, rising at a 7.04% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

This market is rising due to increasing outsourcing of drug development and manufacturing driven by cost pressures, complex biologics demand.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5412

Key Takeaways:

- Germany dominated the Europe pharmaceutical CDMO market in 2024.

- France is anticipated to grow at the fastest rate in the market during the forecast period.

- By product, the API segment registered its dominance over the market in 2024.

- By workflow, the commercial segment held the largest share of the market in 2024.

- By application, the oncology segment held a dominant presence in the market in 2024.

- By end-use, the large pharmaceutical companies segment led the market in 2024.

Market Overview:

The market serves as an essential foundation for the European pharmaceutical and biotechnology industries, providing innovation-focused companies with the ability to outsource Active Pharmaceutical Ingredient manufacturing, formulation, commercial production, and complex biologics work. At the moment, Germany is the market leader in terms of share because of its stronger regulatory framework, sophisticated level of manufacturing capability, and investment in R&D.

The expected fastest growing country during the forecast period is France due to the favourable policy environment, investment incentives, and broader CDMO capacity. Some key market segments include multiple types of API (Active Pharmaceutical Ingredients) products, commercial scale processes, oncology markets and providing services to large pharma companies; they comprise both current market dominance and the nature of future opportunities.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

- Rising demand for new therapeutics & oncology: The rising rates of cancer incidence along with investment in biologics, small molecules and high potency APIs (HPAPIs) is driving increasing interest for investment for pharma companies to seek out external CDMO partners to move quickly in cases where capacity, volume or specialty chemistry is a component.

- Regulatory push and reshoring: The European regulatory and policy framework is supporting local production, local quality standards (GMP, EMA oversight), and a reduced reliance on non-EU suppliers. The impetus for this will also grow as supply chain fragility exposed during the pandemic and the supply of antibiotics became an issue.

- Progress in technology and phase expansion: Progress in continuous manufacturing, digitalization (automation), more complex molecule capabilities, and investment in new facilities, for example API capacity expansion, are allowing CDMOs to deliver more, quicker, and at a higher margin than before.

- Cost and outsourcing pressure: Pharma companies are under pressure to reduce fixed capital expenditures, accelerate time-to-market, and manage risk, making outsourcing to CDMOs more appealing than in-house end-to-end manufacturing.

Key Drifts:

Key Trends Affecting the CDMO Landscape:

European Contract Development Manufacturing Organizations (CDMOs) are committing to more advanced small-molecule chemistry and higher-potency specialized APIs which demand tighter safety, containment and technical skills base. Whilst small molecules and APIs still dominate, there is increased work in biopharma, advanced therapies, viral vectors and gene therapy platforms, which require a different range of CDMO capabilities.

European governments and pharmaceutical companies are calling for greener manufacturing, lower carbon footprints, supply security, efficient energy footprint of plants, and increased local capacity, especially for vital medicines. Automation, process analytics, predictive maintenance, and digital platforms are increasingly used in R&D, process development, regulatory compliance, quality control, to cut cycle times and improve reliability.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

The Cost-of-Manufacturing & Competitive Pressure:

One of the biggest challenges for Europe contract pharmaceutical CDMO market is the significant cost pressure, driven by higher labour, regulatory compliance and energy expenses. European CDMOs must comply with strict regulation, environmental and safety standards, whilst being responsive to rising input prices; all the while competing with CDMO providers in Asia who enjoy much lower labour rates.

The challenge is even greater in API manufacturing particularly for NGOs and essential medicines, where margins are tight and price pressure is aggressive. An example is Europe’s last major manufacturer of certain antibiotic APIs, Xellia, recently announcing the closure of its largest manufacturing plant due to unsustainable costs compared to Asian manufacturers.

Regional Analysis:

Germany:

Germany is still the leading region in the European CDMO market with the highest market share. The region's dominance is backed by high R&D investment, established manufacturing base, rigorous regulations, and a tightly woven web of pharma and biotech companies. This position affords Germany a competitive advantage in attracting both high value API and commercial CDMO business.

France:

On the other hand, France is expected to grow at the fastest rate in the Europe CDMO market. The market is experiencing growth in this region due to favorable policies, increased funding for the biotech sector, and capacity expansions with respect to APIs and drug products. The API market segment in France is experiencing very good market growth and the country is expected to double its revenue over the estimate period.

Download the single region market report @ https://www.towardshealthcare.com/price/5412

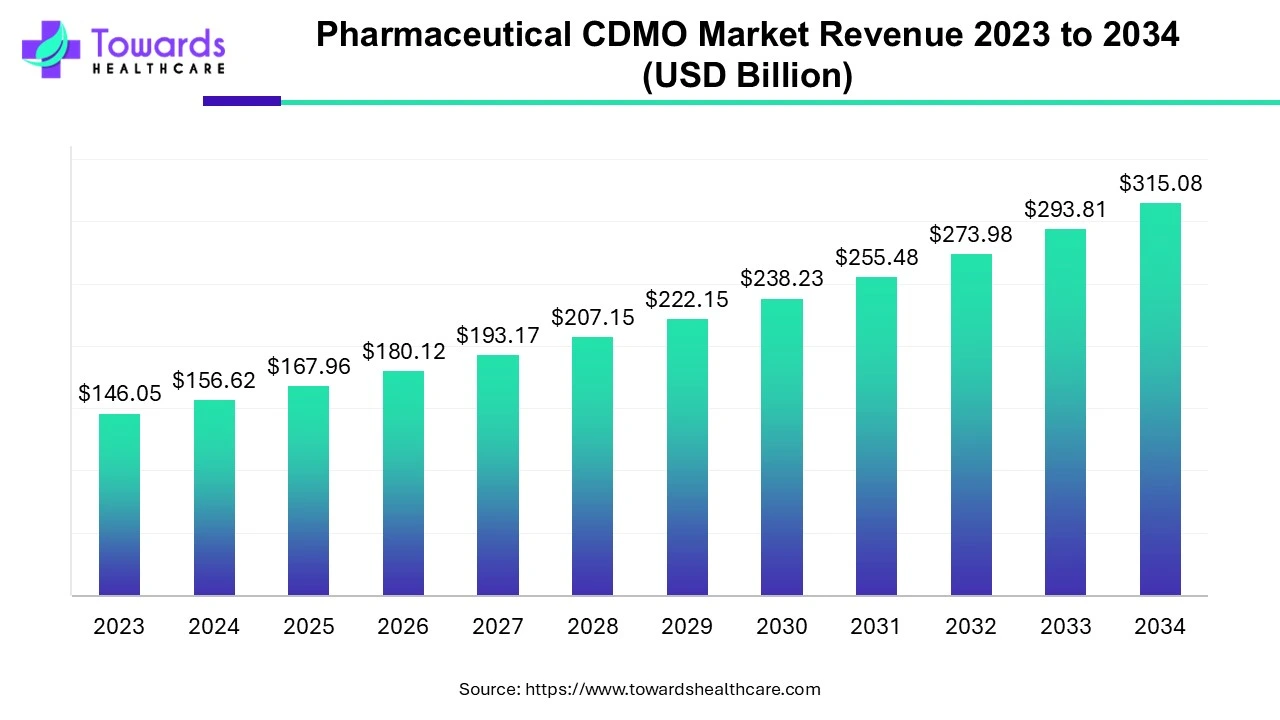

Global Pharmaceutical CDMO Market Growth

The global pharmaceutical CDMO market size was estimated at US$ 146.05 billion in 2023 and is projected to grow to US$ 315.08 billion by 2034, rising at a compound annual growth rate (CAGR) of 7.24% from 2024 to 2034. The pharmaceutical CDMOs are growing due to the growing demand for pharmaceutical products.

Access the in-depth global Pharmaceutical CDMO Market size, trends and competitive landscape @ https://www.towardshealthcare.com/price/5327

Segmental Insights:

By Product:

The Active Pharmaceutical Ingredient (API) segment consists of the greatest revenue share quantitatively in Europe’s CDMO market, simply because the pharmaceutical companies outsource a large portion of their work to CDMOs on APIs, particularly small molecules and specialty/HPAPIs. This segment is also primed for growth because of the high demand and increasing need for novel therapeutics and essential medicine.

By Workflow:

The commercial manufacturing segment retains the largest revenue share. The demand for commercial scale manufacturing is consistently high once products have transitioned through the development and clinical phases. CDMO companies that have developed the commercial infrastructure can rest easy with long-term contracts, stable demand, and economies of scale.

By Application:

Oncology comprises the largest market share in the Europe CDMO market. Research shows that in oncology, due to the increasing global cancer burden, the innovation pipeline is full, whether regarding small molecules, biologics, or targeted therapies. Because many oncology agents are notoriously complex, high potency, and biologics/antibody-drug conjugates, demand is high for CDMO companies that specialize in these areas.

By End-Use:

Large pharmaceutical companies comprise the largest segment. These companies possess the budgets, regulatory knowledge and experience, and scale to outsource large portions of their R&D, API, formulation, and manufacturing business to CDMOs. Large pharma often enters long-term CDMO contracts, which secures CDMO cash flows and encourages capacity investments.

Recent Developments:

In September 2025, AGC Pharma Chemicals invested €110 million into the expansion of its plant in Malgrat de Mar (Barcelona). The plant will increase active pharmaceutical ingredient production capacity by about 30%. The facility, acquired from Boehringer Ingelheim in 2019, is now being upgraded with advanced technologies and sustainability features.

Browse More Insights of Towards Healthcare:

The global viral vector-based cell & gene therapy CDMO market is valued at USD 142.77 million in 2024, rising to USD 162 million in 2025, and is expected to reach approximately USD 497.7 million by 2034. The market is projected to grow at a CAGR of 13.44% between 2025 and 2034.

The global antibiotic CDMO market is on a steady upward trajectory, expected to generate significant revenue growth, potentially reaching several hundred million dollars over the forecast period from 2025 to 2034.

The worldwide life science CDMO market is witnessing robust expansion, with revenues projected to increase significantly by the end of the forecast period spanning 2025 to 2034.

The global veterinary CRO and CDMO market is estimated at USD 7.17 billion in 2024, growing to USD 7.77 billion in 2025, and is forecasted to reach around USD 16.13 billion by 2034, expanding at a CAGR of 8.43% during 2025–2034.

The global investigational new drug CDMO market is valued at USD 5.29 billion in 2024, rising to USD 5.66 billion in 2025, and projected to reach approximately USD 10.34 billion by 2034, with a CAGR of 6.97%.

The global mRNA therapeutics CDMO market is calculated at USD 4.62 billion in 2024, expected to grow to USD 5.15 billion in 2025, and projected to reach around USD 13.63 billion by 2034, growing at a CAGR of 11.37%.

The CDMO Aseptic Filling Solutions market is experiencing strong growth, driven by increasing demand for sterile manufacturing and specialized injectable therapies, and is expected to continue expanding throughout the forecast period.

The global oligonucleotide CDMO market is valued at USD 2.55 billion in 2024, growing to USD 3.11 billion in 2025, and expected to reach around USD 18.37 billion by 2034, registering an impressive CAGR of 21.83%.

The global small molecule CDMO market is estimated at USD 72.81 billion in 2024, rising to USD 78.01 billion in 2025, and projected to reach approximately USD 145.12 billion by 2034, expanding at a CAGR of 7.14%.

The global topical drugs CDMO market is valued at USD 46.32 billion in 2024, expected to grow to USD 51.62 billion in 2025, and projected to reach around USD 136.71 billion by 2034, with a CAGR of 11.43%.

The global cell and gene therapy CDMO market is calculated at USD 6.41 billion in 2024, rising to USD 8.2 billion in 2025, and is expected to reach approximately USD 75.32 billion by 2034, expanding at a remarkable CAGR of 27.94%.

The global biologics CDMO market is valued at USD 22 billion in 2024, increasing to USD 25.41 billion in 2025, and projected to reach around USD 92.79 billion by 2034, growing at a CAGR of 15.48%.

The U.S. pharmaceutical CDMO market is estimated at USD 36.77 billion in 2024, rising to USD 39.14 billion in 2025, and forecasted to reach approximately USD 68.57 billion by 2034, with a CAGR of 6.43%.

Europe Pharmaceutical CDMO Market Key Players List:

- 3P Pharmaceuticals

- Adragos Pharma

- AGC Biologics

- Biovian Oy

- Boehringer Ingelheim

- Delpharm

- Fareva

- FUJIFILM Diosynth Biotechnologies

- Lonza Group AG

- PCI Pharma Services

- Recipharm AB

- Richter Biologics

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/price/5412

Segments Covered in the Report

By Product

- API

- Type

- Traditional API

- Highly Potent API

- Antibody-drug conjugate (ADC)

- Others

- Synthesis

- Synthetic

- Solid

- Liquid

- Biotech

- Synthetic

- Drug

- Innovative

- Generics

- Manufacturing

- Continuous Manufacturing

- Batch Manufacturing

- Type

- Drug Product

- Oral Solid Dose

- Semi-Solid Dose

- Liquid Dose

- Others

By Workflow

- Commercial

- Clinical

By Application

- Oncology

- Small Molecules

- Biologics

- Infectious Diseases

- Neurological Disorders

- Cardiovascular Disease

- Metabolic Disorders

- Autoimmune Diseases

- Respiratory Diseases

- Ophthalmology

- Gastrointestinal Disorders

- Hormonal Disorders

- Hematological Disorders

- Others

By End-Use

- Large Pharmaceutical Companies

- Medium Pharmaceutical Companies

- Small Pharmaceutical Companies

By Region

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5412

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.